Income Tax In Thailand - Tax System in Thailand - GENtres / Thailand taxed incomes earned from all over the world.

Income Tax In Thailand - Tax System in Thailand - GENtres / Thailand taxed incomes earned from all over the world.. All individuals, whether foreign or thai, who work in thailand or have taxable income must apply for a taxpayer's identification number which is issued by the revenue. General taxation on income, how it's calculated, when to pay tax, what exemptions there are and more. Thailand income tax for foreigners: Under section 41 of the revenue code an individual thai citizen or foreigner who lives in thailand for one or more periods totaling at least 180 days in any tax (calendar) year is, for tax purposes. The tax system is progressive.

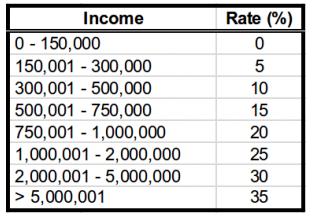

(you cannot file using the calendar year as is standard in thailand. 1st portion up to thb 150,000. Withholding and income taxes (rates are progressive to 35%). Thailand income tax applies to worldwide income, just as the us does. Taxes provide an important source of revenue for various levels of the government of the republic of china.

All individuals, whether foreign or thai, who work in thailand or have taxable income must apply for a taxpayer's identification number which is issued by the revenue.

Our tax advisor magazine is a general information publication of aspects of thailand's tax laws for the meeting of tax compliance obligations and tax rights and entitlements. The following are the tax rates used in 2013/2014. A resident taxpayer is someone who has resided in thailand for a period that totals more than 180 days. This can be issued by the tax office but you need to present id. Thailand is not a tax haven. Withholding and income taxes (rates are progressive to 35%). Income from a foreign source that is brought into thailand within the year. A number of income sources may be included in this assessment. The personal income tax is considered as a principal tax and classified as a direct tax. The first 150,000 baht you earn is tax free, and then a progressively higher. Thailand income tax for foreigners: Tax rates vary depending on your personal income for expat taxes in thailand. A tax credit is granted for dividend income received by an individual domiciled in thailand from locally incorporated companies.

All individuals, whether foreign or thai, who work in thailand or have taxable income must apply for a taxpayer's identification number which is issued by the revenue. Here are the rates (since 2016) Thailand income tax for foreigners: Tax rates vary depending on your personal income for expat taxes in thailand. A tax credit is granted for dividend income received by an individual domiciled in thailand from locally incorporated companies.

Under section 41 of the revenue code an individual thai citizen or foreigner who lives in thailand for one or more periods totaling at least 180 days in any tax (calendar) year is, for tax purposes.

A resident is a person who resides in thailand for more than 180 days in a calendar year. Personal income tax rate in thailand averaged 36.06 percent from 2004 until 2020, reaching an all time high of 37 percent in 2005 and a record low of 35 personal income tax rate in thailand is expected to reach 35.00 percent by the end of 2021, according to trading economics global macro. A resident taxpayer is someone who has resided in thailand for a period that totals more than 180 days. Under section 41 of the revenue code an individual thai citizen or foreigner who lives in thailand for one or more periods totaling at least 180 days in any tax (calendar) year is, for tax purposes. Housing and meal allowances or. (you cannot file using the calendar year as is standard in thailand. All income tax information is summarized by kpmg phoomchai tax ltd., a thai limited company and a member firm of kpmg international cooperative (kpmg international), a swiss entity, based on the thai revenue code, revenue department of thailand. Income earned by a person who resided in thailand for a total of 180 days. Companies incorporated in thailand are taxable on income from all sources. A resident of thailand is liable to pay tax on income from sources in thailand as well as on the portion of income from foreign sources that is brought into thailand. Thailand is not a tax haven. Tax residents must pay taxes on any income they earn in thailand as well as a portion of any income brought in from overseas as noted in section 1 of the revenue department's website. Rates are progressive and range from 0% for those who earn less than 150,000 baht to 35% for those who earn more than 5,000,001 baht.

A number of income sources may be included in this assessment. Personal income tax rates for residents — the deductable rate is applicable to thai citizens or foreigners with the residential status in thailand yes, there is income tax in thailand. Nonresident taxpayers can avail of the spouse allowance and child allowances only if their spouse or children are residents of thailand. The deadline for paying income tax is the last working day in march 2014. Return on the same income.

Thailand income tax for foreigners:

Here are the rates (since 2016) Property tax in thailand for foreigners by selling property or buying. The first 150,000 baht you earn is tax free, and then a progressively higher. Thailand's corporate income tax rate applied to net profits is 20%. Personal income tax (pit) rates. Thailand has a progressive tax system. The tax system is progressive. Thailand income tax for foreigners: In thailand, property buyers share the registration fee with the seller. Tax residents must pay taxes on any income they earn in thailand as well as a portion of any income brought in from overseas as noted in section 1 of the revenue department's website. Taxes provide an important source of revenue for various levels of the government of the republic of china. There are two classifications of taxpayers: Thailand income tax applies to worldwide income, just as the us does.

Komentar

Posting Komentar